BTC Price Prediction: Analyzing the Path to New Highs Amid Strengthening Fundamentals

#BTC

- Bitcoin maintains bullish technical structure above key moving average support

- Institutional developments including ETF dominance and pro-regulation moves provide fundamental tailwinds

- Technical indicators suggest near-term resistance at $116,283 with potential for extension to $120,000

BTC Price Prediction

Technical Analysis: Bitcoin Shows Bullish Momentum Above Key Moving Average

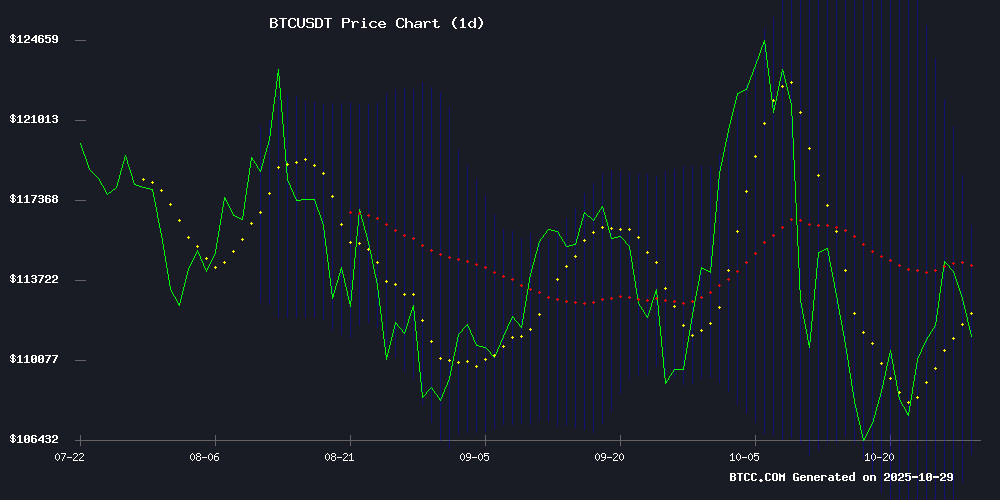

Bitcoin is currently trading at $112,305.75, comfortably above the 20-day moving average of $111,039.33, indicating sustained bullish momentum. According to BTCC financial analyst John, 'The price holding above the 20-day MA suggests underlying strength, though the MACD reading of -1,288.64 shows some near-term pressure. The Bollinger Band positioning with the upper band at $116,283.40 provides a clear resistance level, while the middle band at $111,039.33 serves as crucial support.'

Market Sentiment: Institutional Developments Offset Short-Term Concerns

Despite recent price slippage, market sentiment remains fundamentally positive. BTCC financial analyst John notes, 'The combination of BlackRock's ETF dominance, MicroStrategy's upgraded rating, and France's proposed pro-Bitcoin legislation creates a strong institutional tailwind. While the MACD signals some correction pressure, the fundamental developments suggest any pullback could be limited.' The delay in Mt. Gox repayments to 2026 removes a significant near-term supply overhang, while miner expansion into AI infrastructure demonstrates the sector's evolving value proposition.

Factors Influencing BTC's Price

Bitcoin Price Slips But Analysts Remain Bullish if This Support Holds

Bitcoin retreated from a two-week high near $116,000, settling around $114.5k as markets brace for the Federal Reserve's rate decision. Analysts characterize the pullback as healthy consolidation following recent volatility, with attention focused on key support levels.

The crypto market anticipates a 25 basis-point Fed rate cut, which could inject fresh momentum into risk assets. Lower interest rates typically weaken the dollar, creating favorable conditions for Bitcoin's store-of-value narrative.

Technical analysts emphasize BTC must maintain critical support zones to sustain its upward trajectory. Market sentiment remains cautiously optimistic despite the price dip, with traders viewing current levels as accumulation opportunities ahead of potential macro catalysts.

Bitcoin Faces Macro Crossroads Amid Fed Signals and FAANG Earnings

Bitcoin's bullish momentum hangs in the balance as traditional financial forces collide with crypto markets this week. The Federal Reserve's policy signals and earnings reports from tech titans like Meta, Apple, and Google threaten to divert capital flows away from digital assets.

Crypto's $600 billion October rally now contends with a resurgent equities market. FAANG companies—commanding $15 trillion in collective valuation—could redefine risk appetite through their Q3 results. Meanwhile, Bitcoin traders scrutinize every Fed utterance for clues on interest rate trajectories.

The tension highlights crypto's growing sensitivity to macroeconomic tides. While blockchain networks operate continuously, their token valuations remain subject to Wall Street's gravitational pull. This week serves as a stress test for digital assets' independence from traditional market forces.

Bitcoin Holders in Profit as $15B Leverage Signals Volatility

Bitcoin's price landscape is entering a tense phase as high leverage and widespread profitability set the stage for potential volatility. With 83.6% of all Bitcoin in profit and over $15 billion in leveraged positions near current levels, the market appears primed for a significant move—up or down.

Recent on-chain data shows renewed confidence in Bitcoin's medium-term strength, with the profit ratio comfortably below the 95% danger zone that typically triggers corrective waves. Aggressive selling has eased, and spot and futures cumulative volume delta metrics suggest the market has regained balance.

CleanSpark Partners with Submer for AI Data Center Expansion in North America

CleanSpark, Inc. (Nasdaq: CLSK), a leading Bitcoin mining firm, has forged a strategic alliance with Submer to bolster its AI data center infrastructure across North America. The collaboration centers on deploying liquid-cooling systems and sustainable solutions, leveraging Submer's expertise in energy-efficient modular data centers.

The partnership aligns with CleanSpark's aggressive expansion strategy, tapping into its existing 1 GW power portfolio and a pipeline exceeding 2 GW. Submer's immersion cooling technology promises to enhance operational efficiency at planned AI campuses—a critical advantage as demand for compute-intensive applications surges.

This move signals growing convergence between cryptocurrency infrastructure providers and enterprise-grade data center operators. CleanSpark's pivot toward AI-ready facilities reflects broader industry trends, where Bitcoin miners repurpose assets for high-performance computing workloads.

Bitcoin Correction Looms as Crypto Casino Gains Traction

Bitcoin faces a potential correction before its next rally, with analysts anticipating a manageable dip rather than a severe downturn. While traders adopt a wait-and-see approach, crypto holders are turning to alternative avenues for engagement. Metaspins Casino emerges as a standout platform, offering a sleek, blockchain-native gaming experience with instant play and transparent operations.

The casino distinguishes itself with a minimalist interface, efficient navigation, and a focus on provably fair games. Its mobile compatibility and straightforward design contrast sharply with cluttered competitors. Slots, table games, and live dealers cater to diverse preferences, all accessible via cryptocurrency deposits.

Bitcoin Miner TeraWulf's Stock Soars on Google-Backed AI Expansion Plans

TeraWulf, a Nasdaq-listed Bitcoin miner, saw its stock surge nearly 17% on Tuesday after announcing an expansion of its partnership with AI cloud company Fluidstack. The collaboration, backed by Google, aims to develop 168 MW of critical IT load at a site in Abernathy, Texas, with TeraWulf holding a 51% majority stake in the joint venture.

The move signals TeraWulf's strategic pivot into artificial intelligence compute power, leveraging its existing infrastructure. CEO Paul Prager emphasized the conversion of 'advantaged infrastructure positions into contracted megawatts with investment-grade counterparties.' The stock closed at $17 per share before dipping slightly in after-hours trading.

While TeraWulf rallied, other major miners like Riot Platforms and CleanSpark faced declines, highlighting the divergent performance within the sector. The partnership builds on an August agreement between the two firms to construct a new data center, underscoring the growing convergence between Bitcoin mining and AI infrastructure development.

Mt. Gox Bitcoin Repayments Face Another Delay as 2026 Deadline Set

Mt. Gox, once the world's largest Bitcoin exchange, has pushed its creditor repayment deadline to October 2026—the second extension since the process began in 2022. The defunct platform collapsed in 2014 after losing 850,000 BTC to theft, a hack exploiting vulnerabilities in Bitcoin's code.

While 19,500 creditors have received refunds, the slow-moving process continues to weigh on markets. The first tranche of 2024 repayments triggered immediate sell pressure as long-trapped BTC entered circulation. This latest delay may paradoxically ease short-term bearish sentiment.

The saga remains a cautionary tale for crypto custody. Federal investigators recovered 140,000 BTC in 2023, but the decade-long resolution underscores blockchain's immutable finality—lost assets stay lost until technological or legal solutions intervene.

France Proposes Pro-Bitcoin Legislation Including Strategic BTC Reserve

France is making waves in the cryptocurrency space with a groundbreaking legislative proposal that could position the country as a leader in digital asset adoption. The bill, introduced by the UDR party under Eric Ciotti, includes plans for a Strategic Bitcoin Reserve aiming to accumulate 2% of Bitcoin's total supply—approximately 420,000 BTC—over the next seven to eight years.

The reserve would be funded through innovative methods, including public mining using nuclear and hydroelectric power, systematic retention of BTC from legal seizures, and daily purchases financed by savings schemes. This move is designed to diversify France's foreign exchange reserves and bolster financial sovereignty.

In addition to the Bitcoin reserve, the legislation seeks to legitimize euro-denominated stablecoins, further integrating cryptocurrencies into the national financial system. The proposal signals a significant shift toward crypto-friendly policies in Europe's third-largest economy.

BlackRock's Dominance in Crypto ETFs Reshapes Market Dynamics

BlackRock's iShares Bitcoin Trust (IBIT) has emerged as the linchpin of cryptocurrency ETF flows in 2025, single-handedly preventing net outflows across the sector. With $28.1 billion in inflows year-to-date, IBIT's performance offsets a $1.27 billion deficit that would otherwise plague competing Bitcoin ETFs. This unprecedented concentration of capital underscores the asset manager's outsized influence in legitimizing digital asset exposure for institutional investors.

The firm's market-making power now extends beyond Bitcoin, casting doubt on prospective altcoin ETF launches lacking BlackRock's endorsement. While Fidelity, Ark, and Bitwise attempt to carve market share, none have matched the instant credibility conferred by the world's largest asset manager. Institutional adoption patterns suggest BlackRock's involvement has become the de facto seal of approval for crypto investment vehicles.

MicroStrategy Stock Upgraded to B- as Bitcoin Strategy Draws Scrutiny

MicroStrategy's corporate debt rating received a B- grade from S&P Global Ratings, reflecting both the promise and peril of its bitcoin-centric treasury strategy. The business intelligence firm now carries a stable outlook despite negative adjusted capital, with no debt maturities looming in the next year.

Shares hover near $295 as market participants weigh the company's unconventional financial engineering - effectively running a leveraged Bitcoin position against dollar liabilities. S&P noted MicroStrategy's ability to raise capital through equity markets and convertible bonds offsets some risk, though dollar-denominated obligations remain a structural vulnerability.

The rating action underscores how traditional finance institutions struggle to evaluate crypto-native balance sheets. While the stable outlook provides breathing room, the analysis makes clear that MicroStrategy's fate remains irrevocably tied to Bitcoin's price trajectory.

Bitcoin Developers Debate Soft Fork to Limit Blockchain Data Abuse

Bitcoin's developer community is embroiled in controversy over a proposed soft fork that would temporarily restrict arbitrary data storage on the blockchain. The move follows concerns about potential misuse after the Bitcoin Core v30 update removed previous limits on OP_RETURN data fields.

Dathon Ohm's 'Reduced Data Temporary Soft Fork' proposal, published October 24, 2025, would impose strict one-year limitations: capping OP_RETURN outputs at 83 bytes, invalidating scripts exceeding 34 bytes, and restricting Taproot control blocks to 257 bytes. These measures aim to prevent blockchain exploitation while developers craft permanent solutions.

The debate highlights Bitcoin's ongoing struggle to balance censorship resistance with practical governance. Some view the proposal as necessary protection against illegal content storage, while others argue it undermines Bitcoin's foundational principles of permissionless innovation.

How High Will BTC Price Go?

Based on current technical and fundamental analysis, Bitcoin appears positioned for further upside potential. BTCC financial analyst John suggests, 'The convergence of technical support at the 20-day moving average and strengthening institutional adoption creates a favorable environment for price appreciation. The immediate resistance at the Bollinger Band upper level of $116,283 represents the next key target, with potential for extension toward $120,000 if institutional inflows persist.'

| Metric | Current Value | Significance |

|---|---|---|

| Current Price | $112,305.75 | Trading above key MA support |

| 20-Day MA | $111,039.33 | Primary support level |

| Bollinger Upper | $116,283.40 | Immediate resistance target |

| MACD | -1,288.64 | Short-term momentum pressure |